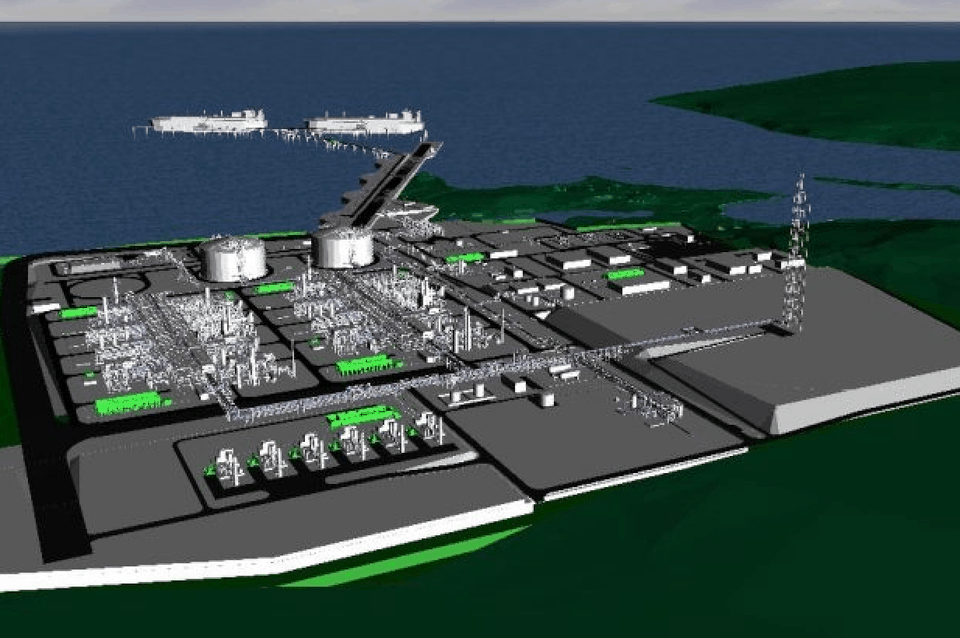

KJIPUKTUK (Halifax) – Waves of precipitous financial distress among Alberta natural gas producers, exacerbated by a recent Supreme Court of Canada decision, appear to be catching up with Pieridae Energy- promoter of the $10 billion proposed Goldboro liquefied natural gas plant in Guysborough County.

Pieridae’s strategy has been to lure customers and investors with a business model that includes securing natural gas prices through ownership of producing gas fields. When the value of smaller Alberta gas producers collapsed in 2017 this approach suddenly became viable.

Even distressed assets going cheap are an acquisition challenge for an ambitious dream with no capital to back it. But Pieridae CEO Alfred Sorenson has been working for years now at teasing out possibilities with promises of $4.5 billion in loan guarantees from the German government.

Pieridae Energy becomes a natural gas producer

In August 2018 Pieridae reached an agreement to buy the soon to be bankrupt Ikkuma Resources, capable of supplying 16% of the gas required for the first phase of the Goldboro LNG plant.

Since Pieridae had and has no cash, this was a no cash acquisition. Ikkuma Resource shareholders got stock in Pieridae- whose sole asset of significance is their work on the LNG production dream. Pieridae got the producing gas fields, the accumulated Ikkuma debt, and its ongoing operating losses of about $2.5 million per month.

There is a long term rationale to what otherwise looks like a crazy idea. The strategy is to lock in the permanently cheap natural gas supply Pieridae needs. The catch of course is that they have to be able to carry this financially with no existing cash flow. And Ikkuma Resources was to be just the first such acquisition for Pieridae Energy.

It is obvious that considerable outside investment is needed to make this business model work. But in the big picture of Pieridae needing to raise around $10 billion- what is several hundred million dollars to digest the gas supply needs? Indeed, Germany’s apparently promised loan guarantees include $1.5 billion earmarked for “upstream development”- acquiring producing gas fields.

Close observers of Pieridae- including its stockholders- expected that the November 2018 absorption of Ikkuma would be closely followed by the granting of the German loan guarantees.

Instead, Pieridae has re-announced its eligibility for the German loan guarantees. Inquiring German MPs have been told by their Minister of Finance that no commitments have been made, and the company seems to deploy a short term hand to mouth process of private placements for Pieridae shares at ever declining prices. A private placement is a sale of stocks, bonds, or securities directly to a private investor, rather than as part of a public offering.

So far that ersatz cash flow has been able to cover the ongoing operating losses of the gas fields, the ramping up design and engineering costs for the LNG plant, and development cost commitments to Trans Canada and Enbridge for planning the considerable pipeline expansions Pieridae needs to get gas to Goldboro. Meanwhile, a $50 million term loan comes due in September- equal to the amount of all the private placements secured so far.

Of course, all of this plate spinning gets “fixed” by the big money coming in. Whenever that is.

Supreme Court decision upends the financing of independent gas producers

By the time the January Redwater Decision came down the surviving junior gas producers were already hanging on by a mere thread. With that decision the Supreme Court reversed the bankruptcy process of paying off creditors of producers before covering the costs of abandoning and cleaning up wells. Financial institutions ran for cover immediately, and struggling gas producers could not get the new loans they needed to keep the lights on.

Last week Trident Exploration simply walked away from 4,500 operating gas wells. There was no bankruptcy- executives and the board of directors simply resigned. Other companies are expected to follow. And for all the grandiose dreams of the LNG plant, Pieridae Energy is now an independent natural gas producer, as was Trident Exploration and the other fallen companies.

Meanwhile, pending Pieridae acquisitions of other gas producers have dropped off the radar. And at a time when most public companies were publishing their First Quarter 2019 financials, Pieridae was belatedly releasing its 2018 Annual Report, without posting it to their web page. There is still no mention of pending first Quarter results, nor of a now overdue Annual General Meeting of shareholders.

The already sliding stock price for Pieridae Energy fell a further 20% in the first three days this week, with the trading volumes increasing as the day progresses.

Update: In the first two hours of today’s trading the stock has dropped another 20% and is nearing $1.00 per share. The strong volumes indicate the stock price has not bottomed out.

The big question is whether the German government will still risk financial commitments to a natural gas producer that no commercial financial institution is willing to make. This becomes all the more doubtful when we consider Germany was hesitating even before Canada’s Supreme Court altered the landscape.

See also: News brief: Fight against Goldboro LNG turns international

With a special thanks to our generous donors who make publication of the Nova Scotia Advocate possible.

Subscribe to the Nova Scotia Advocate weekly digest and never miss an article again. It’s free!

As a former journalist of 13 years, I would expect the writer Ken Summers to call Pieridae to confirm his assumptions before posting them as fact. First, the Annual Report was not late. Year-end results were due to be filed by the end of April and they were filed April 24. The Annual Report was released and posted to SEDAR that day for anyone to see and is on our website. The AGM does not have to be held before the end of June and is set for June 18. Finally, Q1 results are not due until the end of May and we are on track to meet that deadline.

Pieridae remains poised to be the first Canadian company to market LNG to global customers. All major permits are in place, we have a 20-year sales agreement for half the facility’s LNG, US$4.5 billion in German Government loan guarantees remain in place, we own Alberta natural gas to supply Goldboro, agreements have been signed with pipeline companies to use existing infrastructure to transport the gas to Nova Scotia, and we have a signed benefits agreement with the Nova Scotia Mi’kmaq.

We also have a project labour agreement with the 15 trades that make up the Mainland Nova Scotia Trades. Goldboro LNG would be the province’s largest ever mega-project, putting 3,500 people to work during construction and creating 200 permanent jobs.

Mr. Summers chooses to create a dark cloud by crafting a piece that does a disservice to the many Nova Scotians who support this project, including the community of Goldboro who we met with two weeks ago. Their main complaint: why haven’t you started construction yet? They prefer to see sunny skies rather than dark clouds. We couldn’t agree more.

Could you clarify your role with Pieridae Mr. Millar?

The teasing out of possibilities is a good way to describe the various hucksters going around the province promising everything from jobs to prosperity if we just say yes to fracking, salt caverns, and this LNG project. No thanks.

James Millar,

Thanks for alerting me 3 weeks ago to how bad we could expect the First Quarter Financial Results would be. So, you guys finally posted it that JUST before the legal deadline to do so.

We see now that Pieridae has sufficient cash to continue operating for about one more month, covering the over $4 million per month that you lose. And you have given no indication who is going to rescue this time- knowing the crisis in confidence that will cause.

See “First Quarter” at https://pieridaeenergy.com/financial-reports

Will we be hearing from you again Me. Millar?